Capitalization Of Software Implementation Costs Ifrs 16

Accounting for Software Development Costs (ERP Projects) Capitalization IFRS and US GAAPIFRS does not address software development costs directly and some IFRS interpreters actually take the position that costs associated with internally developed software should not be capitalized. However, IFRS states that management may consider more recent “pronouncements of other standard-setting bodies that use a similar conceptual framework to develop accounting standards” and therefore it is possible to argue that best practice under IFRS might be to consider pertinent US GAAP.US GAAP is very explicit in terms of accounting for software development costs (expensed versus capitalized).

- Capitalization Of Erp Implementation Costs

- Capitalization Of Development Costs Ifrs

- Ifrs 16 Implementation Guide

First, the broader issue. In the US, investment in intangible assets has surpassed investment in tangible assets since the late 1990’s. However, if those intangible assets are generated within an ongoing business, they generally do not appear on a company’s balance sheet.

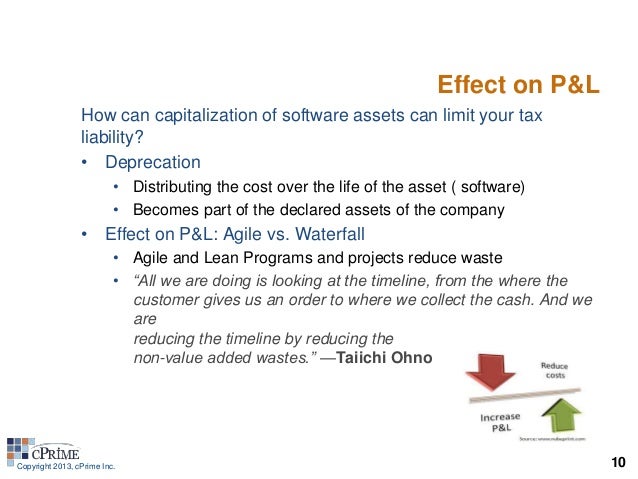

But when companies are acquired, a significant portion of the value is attributable to intangible assets such as software, patented technology, trademarks, brand names, and the like. The fact that some companies’ most vital assets do not appear on their balance sheets is a criticism of US GAAP. In August 2016, the FASB requested feedback on whether to undertake a project on the recognition of internally-generated intangible assets. If such a project proceeds, given the wide range and diversity of intangible assets, there are likely to be challenges to the development of a new accounting model for them. As such, we recommend a phased approach – focusing first on a subset of intangible assets, specifically software, which is arguably one of the more “tangible” intangible assets.

Since there are currently three different accounting models under US GAAP that can be applied to software development (two software-specific models and another for R&D), revisiting the accounting for software development is a logical first step in the overall reassessment of intangible asset accounting. The FASB’s agenda requestChange may be on the horizon. In August 2016, the FASB requested comments on whether their future agenda should include a project on the accounting for intangible assets, including research and development. The FASB also inquired as to whether the potential project should address all intangible assets or instead start with a defined subset. Today’s modelsBecause US GAAP requires research and development to be expensed, many internally-generated intangible assets are not reflected on a company’s balance sheet.This “expense-as-incurred” model, which has been in place for over 40 years, was adopted because—unlike constructing a building or manufacturing inventory—there can be uncertainty as to whether an asset exists at the time the cost is incurred.

Further, even if an asset exists, there were concerns about whether it could be reliably measured and whether any value was correlated to the cost to develop the asset. Assessing feasibilityDevelopment costs associated with software to be sold, leased, or marketed to customers are capitalized only after technological feasibility of the software is established. Determining whether the software is feasible typically involves the completion of a working model that is ready for customer testing.Today, many developers use a modular programming strategy in which programs are divided into components that each perform a specific function, often developed concurrently.The technological feasibility of each component or function may be established long before they are integrated into a working model, which often occurs late in the development timeline. As such, while the existing accounting model allows for software development costs to be capitalized, in practice, often little or none actually are.

What’s changed?In the past, internal-use software primarily related to back-office functions such as inventory management and accounting. These in-house platforms were distinct from the software the company sold or licensed to customers.

Capitalization Of Erp Implementation Costs

Capitalization Of Development Costs Ifrs

However, with the evolution of cloud computing, the lines have blurred between software intended for internal use and software to be sold to customers. The use of software-as-a-service and other cloud-based computing models such as infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS) has increased substantially in recent years and is expected to continue growing at nearly 30% per year. Today, customers may have the option to purchase software that they can download and run on their computer hardware or they can access it in the cloud.

Ifrs 16 Implementation Guide

While the options might be viewed as equivalent from a customer perspective, the accounting for development costs by the seller differ between software that a customer can, or does, take possession of, and software that is offered as a service. Given the significant changes in the technology industry, a question arises as to whether maintaining two different models for software is justified and, more holistically, whether software should be accounted for differently than other technology or intellectual property. Other technologySoftware and other technologies often involve very similar development processes. Whether developing new software, or a new semiconductor chip needed to run that software, companies go through planning and design, development, and testing phases for new technologies.Many new technologies even integrate software and hardware into a single end product, such as a mobile telephone, where the physical handset is virtually inseparable from its underlying operating system and apps. Ultimately, the development of any type of technology involves similar processes, resources, and risks. However, under today’s accounting framework, the resulting intangible asset may or may not be recognized.

Removed Due to CopyrightsThis page has been removed due to a request from Nintendo of America Inc.We are very grateful to have served the emulation community for so many years and to have CoolROM still exist today. We feel we have reached this goal and helped cure more cases of nostalgia than we could have ever imagined.Thank you for all of your support throughout the years - CoolROM will continue strong. We still have titles for 23 systems and this will not change in the foreseeable future!Featured Games. From the very beginning, our goal was to allow users to re-live classic moments from video games that they have lost and cannot purchase anymore. Hamtaro game free download full version.